At Clear Benefit Solutions, your trusted Medicare and insurance professionals, we’re dedicated to keeping you informed about the latest developments that impact your healthcare. As we look at 2025, there are some significant changes to Medicare Part D, thanks to the Inflation Reduction Act (IRA), and we want to ensure you understand how they might affect you.

For years, Medicare Part D, your prescription drug coverage, has had various phases, including the sometimes-confusing “donut hole” or coverage gap. This is all changed 2025, and generally for the better!

The End of the “Donut Hole” and the New $2,000 Out-of-Pocket Cap

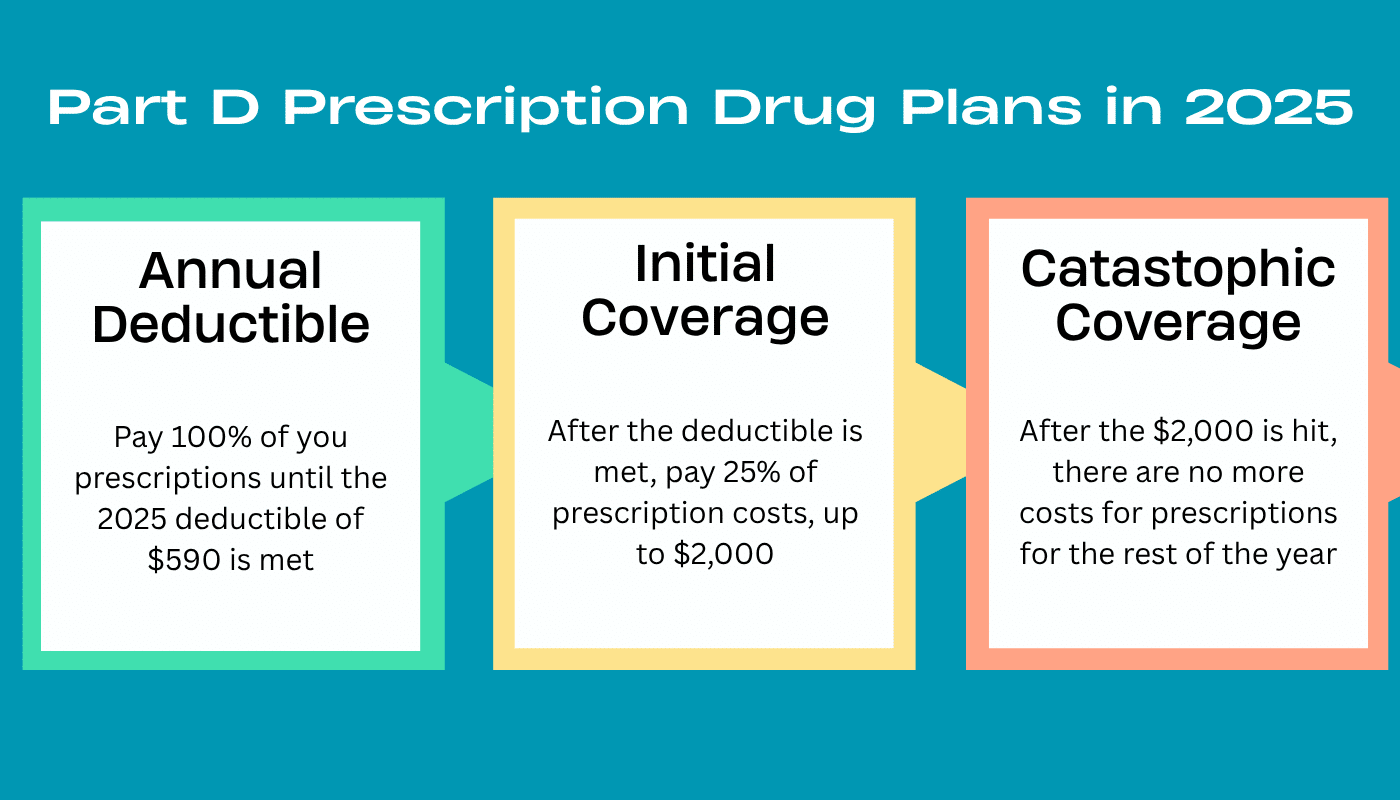

Perhaps the most impactful change for many beneficiaries is the elimination of the Part D “donut hole”. Starting January 1, 2025, that coverage gap phase was gone. This means a simpler, more predictable experience when it comes to your prescription drug costs.

In conjunction with this, a major win for Medicare beneficiaries is the new $2,000 annual out-of-pocket (MOOP) limit for prescription drugs. This cap includes your deductible, copays, and coinsurance for covered medications. Once you hit this $2,000 threshold, you will pay nothing for your covered Part D drugs for the remainder of the year.

We spoke with Erik O’Brien, a Licensed Agent here at Clear Benefit Solutions, who shed some light on these changes.

“Yes, the $2,000 out-of-pocket maximum for prescription drugs is true,” Erik confirms. “Whether someone gets their drugs from a standalone Prescription Drug Plan or through a Medicare Advantage plan, all plans will have this $2,000 maximum starting this year. It’s a fantastic benefit that provides real peace of mind.”

Erik emphasizes his personalized approach: “I really like to take the time to look at each client individually to see what is best based on their specific needs. As changes are made to healthcare, like these Part D updates, I review each client’s situation every year to make sure they continue to have the right coverage.”

He acknowledges that while the $2,000 MOOP is a great step forward, the underlying calculations can be a bit tricky. “The way it all works behind the scenes can be a bit like common core math,” Erik explains. “I understand all the details, but my goal is to explain it in a way that makes sense for you, focusing on what you need to know and how it directly benefits you.”

It’s also important to be aware that, due to these sweeping changes, many plans have had to adjust their formularies and cost-sharing structures. As Erik points out, “Because of this, many plans have had to make changes that actually make a lot of drugs much more expensive.” This underscores the importance of carefully reviewing your plan options.

What This Means for You

These changes from the Inflation Reduction Act are designed to make prescription drugs more affordable and the Part D benefit easier to navigate for millions of Medicare beneficiaries. However, with any significant policy shift, there are nuances to consider.

Here’s what you should do:

-

- Review your current prescription drug needs: Make a list of all your medications, including dosage and frequency.

- Compare 2025 plans carefully: Even if you’ve been happy with your current plan, the changes might mean a different plan is now more cost-effective for your specific prescriptions. Pay close attention to formularies (the list of covered drugs) and how your specific medications are covered under the new structure.

- Consider the new $2,000 MOOP: If you anticipate high prescription drug costs, this cap could be a significant financial relief.

Don’t hesitate to ask for help: This is where Clear Benefit Solutions comes in. Our Medicare and insurance professionals are here to help you understand these complex changes and find the Part D plan that best suits your needs and budget. We can walk you through the details, compare plans, and help you make an informed decision.

The goal of these changes is to provide greater financial security and predictability for Medicare beneficiaries who rely on prescription drugs. While the “common core math” of it all might seem daunting, our team is ready to simplify it for you.

Contact Clear Benefit Solutions today for a personalized review of your Medicare Part D options for 2025!