Medicare Supplements

What are Medicare Supplements?

Medicare Supplements, or Medigap policies, are private insurance plans that help cover the costs not covered by Original Medicare (Part A and Part B). These costs include out-of-pocket expenses such as copayments, coinsurance, and deductibles, which can add up and become quite expensive for Medicare beneficiaries.

How Do They Work?

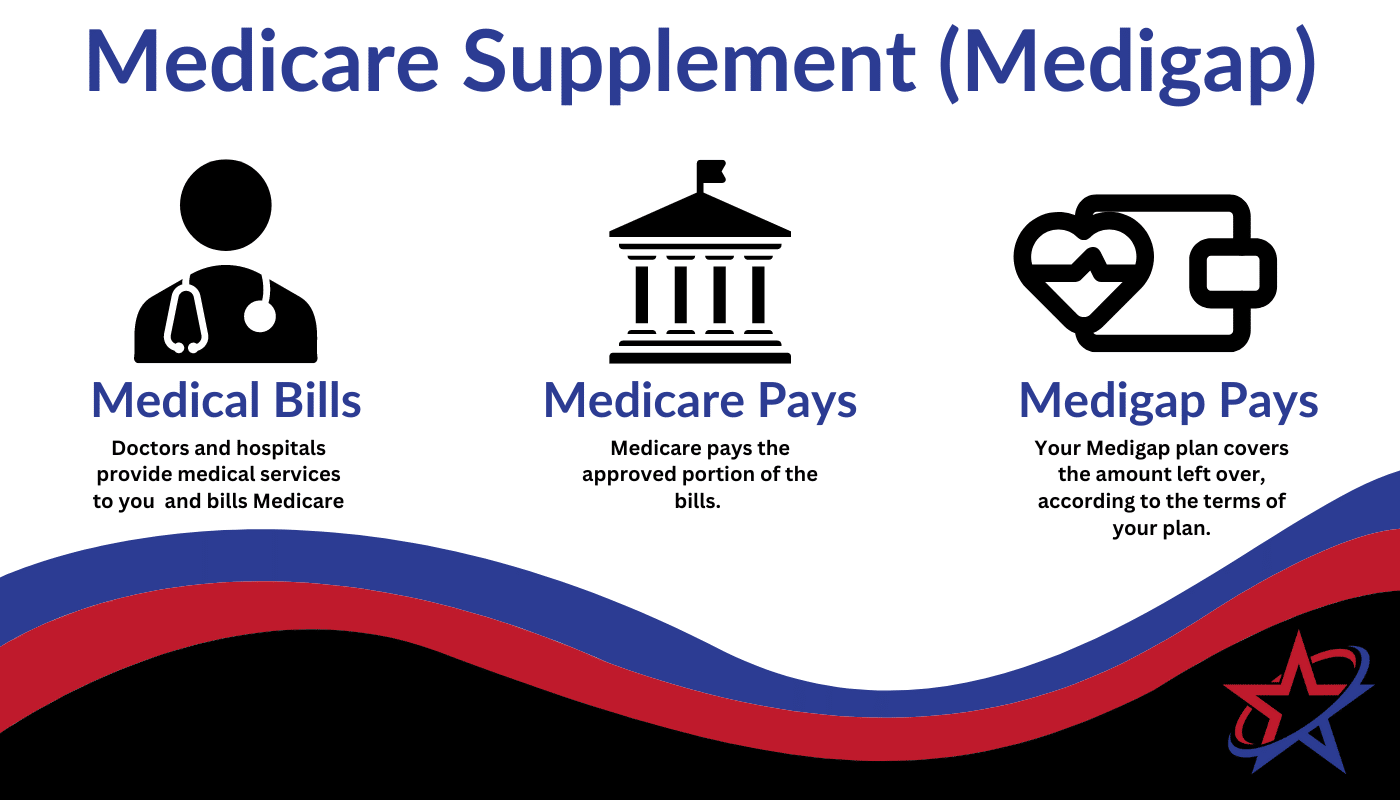

Medigap plans are designed to work alongside your Original Medicare benefits. When you receive medical services, Medicare first pays its share of the approved healthcare costs. Your Medigap policy then steps in to cover the remaining expenses, significantly reducing your out-of-pocket costs and providing you with greater financial protection.

Key Features

Standardized Benefits: All Medigap plans offer the same standardized benefits, regardless of the insurance provider. This means that a Plan G from one company will provide the same coverage as a Plan G from another company, making it easier to compare options.

Guaranteed Renewable: As long as you continue to pay your premium, your Medigap policy cannot be canceled. This guarantees that you will have continued coverage even if your health situation changes.

Nationwide Coverage: Medigap policies offer nationwide coverage, allowing you to use any healthcare provider that accepts Medicare. This is especially beneficial for those who travel frequently or live in different parts of the country during the year.

Not Medicare Advantage: It is important to understand that Medigap policies supplement Original Medicare, whereas Medicare Advantage (Part C) plans are an alternative way to receive Medicare benefits. Medicare Advantage plans often include additional benefits and have their own network of providers, which is different from the broad access provided by Medigap policies.

Advantages

Some of the primary advantages of a traditional Medicare Supplement policy include:

- Freedom to Choose Providers: You can choose your own doctors and hospitals anywhere, as long as they accept Medicare.

- Specialist Access: You can see any specialist you want without needing a referral from your primary doctor.

- Predictable Expenses: Out-of-pocket costs for Medicare-covered services are predictable.

- Nationwide Coverage: You can use your plan anywhere in the United States.

- Guaranteed Renewability: The insurance company can never drop you or change your coverage due to a health condition.

- No Claims Paperwork: Medicare Supplement companies handle claims directly with Medicare. When your provider files a claim with Medicare, it is automatically filed with your supplement company as well.

- Supplement insurance for seniors with Medicare provides the most predictable coverage available. You’ll know exactly what’s covered for every inpatient or outpatient procedure based on the Medicare Supplement plan you choose.

Eligibility and Enrollment

To buy a Medigap plan, you need Medicare Part A and Part B. The best time to enroll is during your Medigap Open Enrollment Period, which starts when you are 65 and enrolled in Part B. During this period, you can’t be denied coverage due to pre-existing conditions.

Choosing a Plan

There are several Supplement Insurance plans available. Contact us to compare different plans and premiums to find the best option for your needs and budget. We are here to listen to your needs and go over all the plans available to you, ensuring you make an informed decision.

Get Help

For personalized guidance, speak with one of our licensed insurance agents. Contact us today for more information and assistance in choosing the right Medigap plan. We are dedicated to understanding your needs and helping you navigate all available options.

What You Can Expect From Us

Trusted & Experienced

We are trusted and experienced in guiding clients through the complexities of Medicare and beyond. With our expertise, you can confidently make informed decisions about your health insurance coverage.

Reliable & Fully Insured

We are always reliable, ensuring you receive the support you need. Additionally, our services are fully insured, providing you with peace of mind.

Communicative

We are committed to providing you with the best options that perfectly fit your needs, ensuring clear and consistent communication every step of the way. Don’t hesitate to reach out to us at any time; we’re here to assist you whenever you need.

Here for You

We are here to help make Medicare easy by simplifying the process and providing you with clear benefit solutions. Our goal is to ensure you have the knowledge and support needed to choose the best options for your needs.

(616) 320-8181

Call Us Today or Click to fill out our Contact Form

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area, and any information we provide is limited to those plans we do offer in your area. Please get in touch with Medicare.gov or 1-800-MEDICARE to get information on all your options.