What Does Basic Medicare Cover? And What Does It NOT Cover?

Medicare is a foundational piece of the healthcare puzzle for millions of Americans, providing a safety net for medical expenses as we age. However, “Basic Medicare”—also known as Original Medicare—is not a one-size-fits-all solution. It’s crucial to understand exactly what it covers and, perhaps more importantly, what it doesn’t.

At Clear Benefit Solutions, we believe that informed choices are the best choices. Our goal is to simplify this complex topic so you can feel confident and secure in your healthcare decisions.

What Is Original Medicare?

Original Medicare is a federal health insurance program that is comprised of two parts:

- Part A (Hospital Insurance): This part primarily covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Think of Part A as covering the “brick and mortar” of healthcare—the big-ticket items related to a hospital stay.

- Part B (Medical Insurance): Part B covers the services and supplies that are medically necessary to treat a health condition. This includes doctor visits, outpatient care, durable medical equipment (like wheelchairs and walkers), and many preventive services. Part B is all about outpatient care and medical appointments.

Together, Part A and Part B form the foundation of your Medicare coverage.

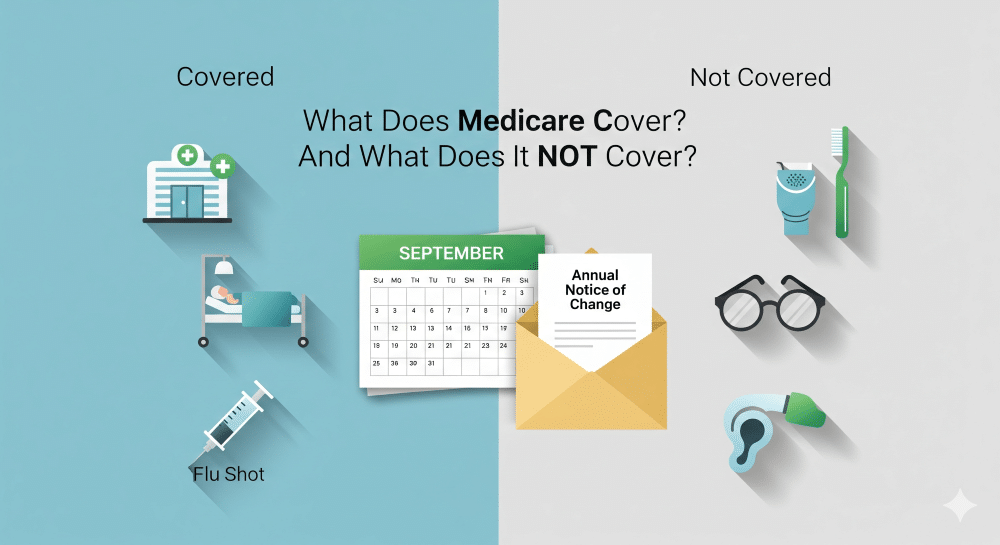

What Does Original Medicare Cover?

Original Medicare covers a wide range of services and items, but it’s important to know the specifics. Here’s a breakdown of what you can expect to be covered under Parts A and B:

Part A: Hospital Insurance

- Inpatient Hospital Care: This includes semi-private rooms, meals, general nursing, and drugs you receive as an inpatient.

- Skilled Nursing Facility Care: If you need skilled care after a hospital stay, Part A covers services like physical therapy, skilled nursing care, and other medical services for a limited time.

- Hospice Care: If you are terminally ill, Part A covers hospice care, which provides comfort and support services.

- Home Health Care: This includes part-time skilled nursing care, physical therapy, and other services for a short period of time.

Part B: Medical Insurance

- Doctor and Clinical Services: This is the most common use of Part B, covering visits to doctors, specialists, and other health care providers.

- Outpatient Care: This includes hospital outpatient services, emergency room visits, and services at ambulatory surgical centers.

- Preventive Services: A key benefit of Part B is its coverage of preventive care, such as flu shots, cancer screenings, and your annual “wellness visit.” These services are crucial for early detection and prevention of diseases.

- Durable Medical Equipment (DME): Medicare Part B covers medically necessary DME, which your doctor prescribes for use at home. This can include items like oxygen equipment, wheelchairs, and blood sugar monitors.

- Ambulance Services: If you need an ambulance to get to a hospital or skilled nursing facility, Part B covers these services when medically necessary.

What Does Original Medicare NOT Cover?

This is where the conversation becomes critically important. While Original Medicare provides a solid base, it has significant gaps in coverage. These “gaps” can lead to high out-of-pocket costs, and this is why so many people choose to supplement their basic coverage with other plans.

Here’s a look at what Original Medicare generally does not cover:

- Prescription Drugs: This is a major gap. Original Medicare does not cover most outpatient prescription drugs. For this, you would need to enroll in a separate Part D plan or a Medicare Advantage plan that includes drug coverage.

- Out-of-Pocket Costs: Original Medicare has deductibles, copayments, and coinsurance that you are responsible for. These costs can add up quickly, especially during a long hospital stay or for frequent doctor visits. For example, after meeting a deductible, you are responsible for a 20% coinsurance for most Part B services. There is no annual cap on these costs.

- Routine Dental Care: Original Medicare does not cover routine dental services like cleanings, fillings, tooth extractions, or dentures.

- Routine Vision Care: It does not cover routine eye exams, eyeglasses, or contact lenses. It will, however, cover services related to a medical condition like glaucoma or cataracts.

- Routine Hearing Care: Original Medicare does not cover routine hearing exams or hearing aids.

- Long-Term Care: This is one of the most significant and common misconceptions about Medicare. It does not cover long-term custodial care, such as assistance with daily living activities (bathing, dressing, etc.) in a nursing home or assisted living facility.

- Care Outside of the U.S.: For the most part, Original Medicare does not cover health care you receive while traveling outside the United States.

The Annual Notice of Change (ANOC): Your September Homework

This brings us to a crucial point about timing. As we enter the month of September, people who are enrolled in Medicare Advantage (Part C) or a standalone Prescription Drug (Part D) plan will be receiving an important document in the mail: the Annual Notice of Change (ANOC).

This document is your plan’s official way of telling you what will change for the upcoming year. It’s an essential piece of mail and should not be ignored.

Why is it so important to read your ANOC this year?

We have been seeing a number of plans ending at the end of this year, and others are adding premiums where there wasn’t one before. These changes can have a major impact on your budget and access to care.

- If you’re happy with what you see: If you read your ANOC and are satisfied with the changes (or lack thereof), you don’t need to do a thing. Your plan will automatically renew on January 1st with the new changes, and you can “chill out” until next year.

- If you’re not happy or are unsure: If you see an unexpected premium, a change to your medication coverage, or notice that your favorite doctor is leaving the plan’s network, or possibly even that your plan will be ending, you should take action. This is the perfect time to call our office at 616-320-8181 and ask questions or set up an appointment to review your options for the upcoming year.

The Annual Enrollment Period (AEP): Your Window of Opportunity

The window to make changes to your Medicare plan is known as the Annual Enrollment Period (AEP). This period runs from October 15th to December 7th every year.

During this time, you have the opportunity to:

- Switch from Original Medicare to a Medicare Advantage plan.

- Switch from one Medicare Advantage plan to another.

- Enroll in or switch a standalone Part D Prescription Drug plan.

- Drop your Medicare Advantage plan and return to Original Medicare.

Why You Should Work With a Medicare Agency Like Clear Benefit Solutions

Navigating the complexities of Medicare is what we do. Our job is to simplify this process for you. We take the time to:

- Understand Your Needs: We sit down with you to discuss your health needs, your doctors, your prescriptions, and your financial situation.

- Go Over Your Coverage: We’ll help you read and understand your Annual Notice of Change so you know exactly what is happening with your plan.

- Plan Together: We work with you to find a plan that not only fits your needs but also makes you feel comfortable and secure.

We believe in making Medicare easy to understand so you can focus on what’s most important: your health. Don’t let the ANOC letter sit on your counter unread. It’s a key to making sure you’re protected for the year to come.

Contact Clear Benefit Solutions today to review your coverage or start a plan that fits your needs. We’re here to help.